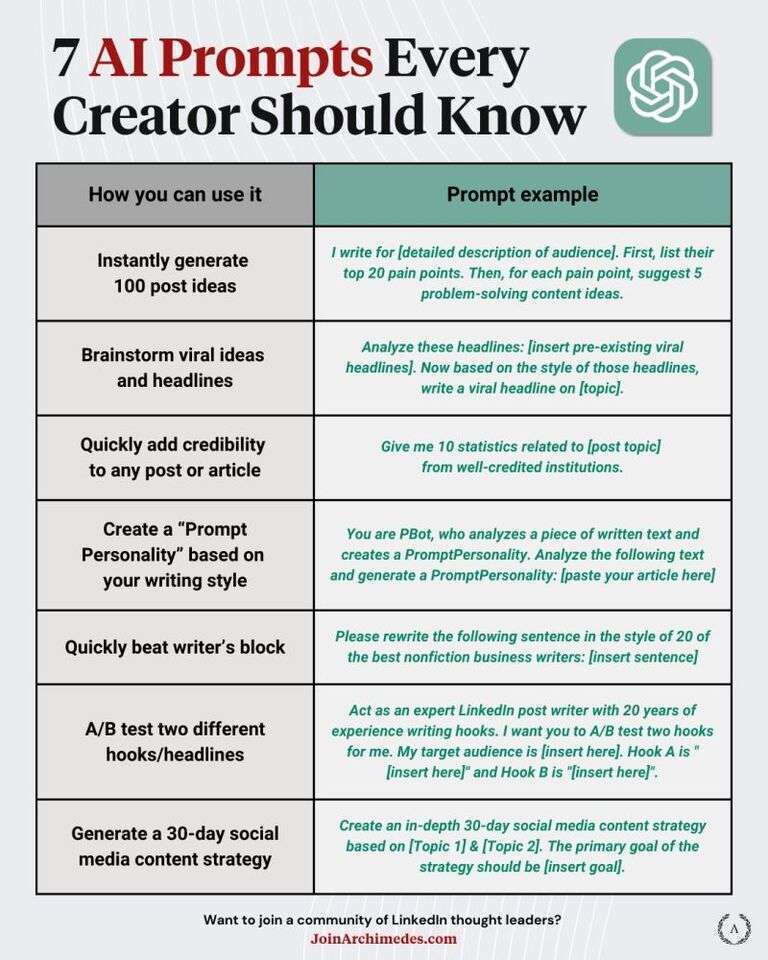

“Housing is always a safe stable investment” my parents used to say this to me. You can forgive them. While there are exceptions (cough, cough, 2008) this statement is generally true. The population is always rising, but the amount of land stays the same… especially in cities… where the jobs are. So, demand is generally always higher than supply. So, the price of housing just continues to rise and rise and rise.

Above is a graph showing the price of homes related to the median annual household income. It now takes five and a half years of working an average job to pay for an average home. And this assumes you spend your money on nothing else!!! Buying a home is now becoming unaffordable for the average person. Bye bye American dream.

Oh, and by the way… the cheaper homes, the starter homes are the ones that are being removed from the market. This is because of multiple factors.

Large companies buying up homes to rent off tend to focus on starter homes. (Low-income renters tend to be easier to manage, less lawsuits)

Starter homes are easier to demolish and turn into other things (apartment buildings, freeways, office buildings, etc). This is because the rich have enough money to hold on to their houses during downturns and they are more likely to sue.

A large number of people want starter homes (like the whole millennial and gen z generation) so they get gobbled up quickly

The older generations are living longer and are not selling their houses. Plus a lot of them have accumulated enough wealth to buy multiple houses.

And now we have to deal with Interest rates…

In an effort to curb inflation with its one and only tool the Federal Reserve is increasing interest rates. Rates have jumped from around 3% to over 7% on a 30-year fixed mortgage. What does this mean for the average person…

Source unusual whales twitter account

So yeah, the average person now has much higher monthly payments unless they locked in low rates. This is likely to slow down the entire economy… but what about the housing market…

The housing market is seeing much less demand, because people smartly don’t want to pay those large monthly rates. However, house prices have not shifted. People are not selling off their homes. Generally selling you home means buying one to, which is not fun in this environment.

Location Location Location

Of course, a lot of this discussion is really relevant to where exactly you want to buy a house. Some areas, despite interest rates, are relatively affordable. Other areas may make you consider moving.

Here is a great article with an interactive graph describing interest rates: This 3D Map Shows America's Most Expensive Housing Markets - Metrocosm.

Speculation time

Having seen the rising consumer debt and the ever-increasing interest payments, it does not take a genius to start wondering “What happens when people can no longer afford to keep paying their mortgages. At some point I have to imagine that people are going to be forced to sell their homes. Couple this with the lack of demand (because of high interest rates), I imagine home prices will have to drop. So thats my prediction. I think we are about to hit a time, where people like my parents (“Housing is always a safe, stable investment”) are wrong.

See anything wrong with my predictions? have more data to add? Leave a comment or better yet edit this page directly. Midflip is a crowd sourcing site and this is a collaborative page.

Hot comments

about anything